Concept

Basic content of indicators

English: technical analysis indicators

This indicator class should consider all aspects of market behavior and establish a mathematical The model gives a mathematical calculation formula to get a number that reflects the intrinsic essence of a certain aspect of the stock market. This number is called the index value. The specific numerical values and interrelationships of indicator values directly reflect the state of the stock market and provide guidance for our operational behavior. Most of the things reflected by the indicators are directly invisible from the line information table.

Analysis of technical indicators (6 photos)

Analysis of technical indicators is based on certain mathematical statistical methods, using some complex calculation formulas to determine the quantification of exchange rate trends Analysis method. There are mainly momentum indicators, relative strength index, stochastic index and so on. Since the above analysis often requires the support of certain computer software, it is only a general understanding for investors in individual real trading transactions. However, it is worth mentioning that technical indicator analysis is an exchange rate analysis and forecasting tool that professional foreign exchange traders in the international foreign exchange market rely heavily on.At present, there are countless various technical indicators in the stock market. For example, the relative strength indicator (RSI), the stochastic indicator (KD), the trend indicator (DMI), the smoothing average line of similarity and difference (MACD), energy wave (OBV), psychological line, deviation rate, etc. These are all well-known technical indicators, which are always prosperous in stock market applications. Moreover, as time goes by, new technical indicators are still emerging. Including: MACD (Smoothing Convergence and Divergence Moving Average) DMI Trend Index (Trend Index) DMA EXPMA (Exponential Average)TRIX (Triple Exponential Smoothing Moving Average)BRAR CR VR (Volume Variation Rate) OBV (Energy Wave) ASI (Vibration Up and Down Index) EMV (Simple Volatility Index) WVAD (William Variation Dispersion) SAR (Stop Loss Point) CCI (Contemporary Index) ROC (Rate of Change Indicators) BOLL (Bolin line) WR (Williams indicator) KDJ (stochastic indicator) MIKE (Mike indicator ).

Purpose

KD is developed on the basis of WMS, so KD has some characteristics of WMS. When reflecting stock market price changes, WMS is the fastest, K is the second, and D is the slowest. When using the KD indicator, we often call the K indicator a fast indicator and the D indicator as a slow indicator. The K indicator reacts quickly, but it is prone to errors, and the D indicator reacts slowly, but it is steady and reliable.

How to use

1. Considering the value of KD, above 80 is an overbought area, below 20 is an oversold area, KD over 80 should be considered for selling, and less than 20 should be considered for buying.

2. Considering the crossover of the KD indicator, K above D is a golden cross. In order to buy a signal, the position of the golden cross should be relatively low, in the oversold zone, the lower the better. The number of crosses is at least 2 times, the more the better.

3. Consider the divergence of the KD indicator

(1) When KD is at a high position and two downward peaks are formed, and the stock is still rising at this time, this is called top divergence, which is selling Signal.

(2) When KD is at a low level and a bottom is higher than a bottom, and the stock price continues to fall, this constitutes a bottom divergence and is a buy signal.

4. If the value of J indicator exceeds 100 and is lower than 0, it belongs to the abnormal area of the price. More than 100 is overbought, less than 0 is oversold, and the signal of J value does not appear frequently, once it appears, the reliability is quite high .

Use experience

1. When the stock price fluctuates sharply in the short-term or the instant market amplitude is too large, the KD value cross signal is used to buy and sell, and the dilemma of buying at high points and selling at low points often occurs. At this time, you must abandon the use of KD stochastic indicators and use CCI, ROC, and BOLLINGER BANDS. ··· and other indicators. However, if the volatility is large enough and there is still a profit after deducting the handling fee between transactions, at this time, change the screen to a five-minute or fifteen-minute graph, and then trade with the cross signal of the KD indicator to gain a little profit.

2. Extremely strong or extremely weak market conditions will cause the indicator to hover up and down in the overbought or oversold zone, and the K value will also be issued in this situation. You should refer to VR and ROC indicators to observe whether the stock price exceeds the normal distribution range. Once determined as Extremely strong and weak trends, the K value's over-trading function will lose its effect.

3. Replacing the K value with the D value will make the overbought and oversold function more effective. Generally, in the normal market, when the D value is greater than 80, the stock price often falls downward; when the D value is lower than 20, the stock price tends to rise upward. In extreme market conditions, when the value of D is greater than 90, the stock price is prone to an instant reversal; when the value of D is less than 15, the stock price is likely to rebound in an instant.

Calculation formula

1. Before generating KD, generate the immature random value RSV first. The calculation formula is: N-day RSV=[(Ct-Ln)/(Hn-Ln)] ×100

2. Perform exponential smoothing on RSV to get the following K value: Today’s K value=2/3×yesterday’s K value+1/3×today’s RSV

In the formula, 1/3 is the smoothing factor, which can be artificial Selected, but it has been established by convention and is fixed at 1/3.

3. Perform exponential smoothing on the K value to get the following D value: Today’s D value=2/3×yesterday’s D value+1/3×today’s K value

In the formula, 1/3 is the smoothing factor, which can be Changing it to another number has also become an agreement, and 1/3 has also been fixed.

4. When introducing KD, there is often a J index attached. The calculation formula is: J=3D-2K=D+2(D-K). It can be seen that J is D plus a correction value. The essence of J is to reflect the difference between D and D and K. In addition, the calculation formula for the J indicator in some books is: J=3K-2D

Classification

There are quite a few indicators for technical analysis, and there are nearly 100 default system indicators. , Even professional analysts are sometimes easily confused. In order to solve this problem, Qianlong Windows analysis system divides all indicators into "trend type", "overbought and oversold type", "trend type", "energy type" and "energy type" according to the design principles and application rules of the indicators. Ten types such as volume type, "average line type", "chart type", "stock selection type", "path type", and "stop loss type". As long as the user knows which category the indicator belongs to, he almost knows the application rules of the indicator; similarly, as long as the user understands his needs (for example, whether to judge the trend or look for overbought and oversold areas), he can easily Find the appropriate technical indicators in the corresponding category.

This classification of technical indicators is also convenient for users to learn, understand and remember the principles of the indicators.

General trend type

Including: ABI, ADL, ADR, ARMS, BTI, C&A, COPPOCK, MCL, MSI, OBOS, TRIM, STIX , TBR.

Qianlong Software categorizes various types of indicators dedicated to judging the trend of the market. General indicators cannot be used in individual stocks (except for COPPOCK indicators).

Overbought and oversold

Including: CCI, DRF, KDJ, K%R, KAIRI, MFI, MOM, OSC, QIANLONG, ROC, RSI, SLOWKD, VDL, W%R, BIAS, BIAS36, Bollinger limit, limit width.

About one-fifth of the indicators belong to this type. They are completely applied and explained locally and are quite complicated. However, as long as you master the characteristics of its "antenna" and "ground wire", all kinds of problems are It can be solved easily.

The antenna and the ground wire are parallel to the central axis. The antenna is located above the central axis and the ground wire is below the central axis. Both have the same distance from the central axis. The antenna can be regarded as indicator pressure or the rising limit in the normal market. The ground line can be regarded as indicator support or the limit of decline in the normal market. The normal market here refers to the situation in which the rise and fall are mutual, the trend fluctuations are carried out in the mode of wave theory, and the indicators continue to fluctuate up and down and within a fixed range. Continuous sharp rises and falls or instantaneous rises and falls cannot be regarded as a normal market.

Trend type

Including: ASI, CHAIKIN, DMA, DMI, DPO, EMV, MACD, TRIX, ultimate indicators, VHF, VPT, Qianlong Long-term, Qianlong short-term, WVAD.

This type of indicator has at least two lines, and the indicator uses the intersection of two lines as a signal:

Signals of trend indicators are generally based on the intersection of two lines. Accurate, grasp this key point and you can use it freely.

Energy type

Includes: BRAR, CR, MAR, Mace line, mental line, VCI, VR, MAD.

This type of indicator is a thermometer for stock price enthusiasm, which is designed to measure investor sentiment or frustration.

The indicator data is too high, which means high-pitched fever;

The indicator data is too low, which means frustration and chills;

Volume type

Includes: ADVOL, transaction value, negative volume index, OBV, positive volume index, PVT, volume, SSL, Qiu's volume method, cost distribution.

Volume types include N-shaped fluctuation type and O-axis crossing type. The signs of signal occurrence are:

Linear moving average

Including: BBI, EXPMA, MA, VMA, HMA, LMA.

It is the average line of various algorithms. Mainly through the result of the short-term moving average crossing the long-term moving average, it is judged whether it is a buying and selling signal.

Chart type

Includes: K line, U.S. line, compressed chart, closing price line, equal volume line, LOGB, LOGH, LOGK, equal volume K line, ○× map, new three-price line, pagoda line, new pagoda line.

It is a price graph derived based on the K-line. Through the characteristic form and combination of the graph, it can judge the buying and selling signals and forecast the rise and fall.

Stock selection type

Including: CSI, DX, PCNT%, TAPI, PowerRadar, SV.

The main purpose is to screen a class of indicators for stocks with investment value.

Path type

Includes: Bollinger Band, ENVELOPE, MIKE, Fenglin Mountain.

Also known as pressure support type. The graph is divided into upper limit and lower limit. The upper limit represents pressure and the lower limit represents support. The characteristics of its indicator graphics are: stock price will retreat when it touches the upper limit; the stock price will rebound when it touches the lower limit; different indicators have special and different meanings.

Stop loss type

Including: SAR, VTY.

This kind of indicator not only has the function of stop loss but also has the function of reversing trading. Therefore, this indicator cannot be viewed solely in the concept of stop loss, but a relatively independent trading system that generates trading signals. .

If the stock price rises, the stop-loss circle (red) is below the stock price;

If the stock price falls, the stop-loss circle (green) is above the stock price;

The price breaks through the circle from bottom to top (green) as a buy signal;

The closing price drops from the top to the circle (red) as a sell signal.

Technical indicators are classified according to the calculation method

There are five prices that can be used for calculation, the opening and closing prices, the highest and lowest prices, and the K-line The median price indicated above. There are countless mathematical methods that can be used. In addition to the four arithmetic operations of addition, subtraction, multiplication and division, you can also weight, average, square roots, find logarithms, and so on.

The most basic indicator is the average line. You can use the price of the previous five days to do the average, or you can use the price of the previous ten days to do the average. A curved and beautiful curve can be drawn on the K-line. According to the calculation method, there are three averages, the simple moving average. Weighted moving average. Exponentially smoothed moving average.

The first type of trend indicators can be generated. As long as the exponential smooth moving averages of different periods are combined together, a line will be drawn on the icon. These When the line runs unilaterally in the market, it forms a pattern like a crocodile with an enlarged mouth. This is the crocodile line.

The BOLL band is also based on the moving average. It also adds the parameter of the K-line slope, adding and subtracting a price from the average to form three Bollinger bands. When the price continues to move, the slope of the K-line increases. When the bell is enlarged, when the price touches the three tracks, there is a certain degree of adjustment.

CCI should be a trend indicator because of the calculation method, but because it directly applies the negative value to the calculation, it also reflects a certain degree of shock.

Price shocks have strengths and weaknesses. Based on the statistics of the fluctuations in the length of the K-line and the height of the shadow, smart traders invented the oscillation volume indicator. Today's price can be compared with yesterday's price, or compared with the price of any previous day, and a relative conclusion can be drawn. Such as RSI, KDJ, etc.

RSI translation is called Relative Strength Index. It uses today's closing price to compare with the price of a certain day before, draws a jump fluctuation line, and then takes the same fluctuation line as the heart rate chart and makes an average value of the coefficient to get a relatively smooth curve. This curve fluctuates between 0 and 100 coefficients. According to observations, it is easy to conclude that 30 and 70 can be used as the starting point for the transaction. Draw a tangent line on the RSI curve and compare it with the K line to get the market divergence. Or called market divergence.

For example, when the stock price has a new high and the RSI value has not surpassed the previous high, it is possible to diverge, that is, the market is about to reverse. At this time, traders can trade short when the RSI crosses below 70.

MACD (sound: Mark Di) is actually a combination of trend indicators and oscillators.

According to the market's transaction volume, a type of indicators can also be calculated, such as BBD, DDE and other domestic patents that describe the difference between large and small orders Technology. In the 24-hour international market, the trading volume is carried out in different currencies between different exchanges, and it is impossible to form statistics.

Introduction

BIAS deviation rate< /b>

The deviation rate represents the difference between the closing price of an individual stock and the moving average. The greater the positive deviation rate, the greater the short-term profit, the higher the possibility of profit-taking; the greater the negative deviation rate, the higher the possibility of short covering. According to the difference between the closing price of a stock and the average price of different days, different BIAS lines can be drawn.

Parameters: The system draws three BIAS lines, which are the difference between the closing price and the moving average price of L1, L2, and L3.

DMI trend indicator (standard)

DMI Chinese name trend indicator is a very commonly used indicator. Its basic usage is to look at the intersection of +DI and -DI. +DI crosses -DI from bottom to top, it is a buy signal; +DI crosses downwards -DI is a sell signal. If ADX is below 20, it means that the stock price is in a consolidation period and should stay on the sidelines; ADX breaks through 20-30 and climbs upwards, and there will be a considerable ups and downs; ADX is above 50 and suddenly turns and reflexes, no matter it is at this time A rise or fall indicates that the market is about to reverse.

Parameter: N count days; M interval days, generally 14, 6. The ADXR line is the average value of the ADX value of the day and the ADX value of the day M.

EXPMA exponentially smoothed moving average

In order to solve the problem of lagging behind the moving average, analysts also seek the EXPMA moving average indicator to replace the moving average. . EXPMA can adjust the direction immediately with the rapid movement of the stock price, effectively solving the problem of lagging signals. When the first EPMA crosses the second EXPMA from bottom to top, it will give rise to the stock price. When the first EXPMA crosses the second EXPMA from bottom to top, it will push down the stock price. When the stock price touches EXPMA from bottom to top, it is easy to encounter great pressure to retreat. When the stock price touches EXPMA from top to bottom, it is easy to encounter a big support rebound.

Parameter: P1, P2, P3, P4 exponential smoothing moving average of the closing price. Generally take 5th, 10th, 20th, 60th.

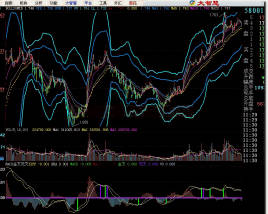

KDJ Stochastic Indicator

The K value is around 20, and the upward cross D value is a short-term buy signal. The K value is around 80, and the downward cross D value is a short-term sell signal. The K value forms a phenomenon where the bottom is higher than the bottom, and at a low level below 50, when the D value is crossed twice from bottom to top, the stock price will rise more. The K value forms a phenomenon that one top is lower than one top, and at a high level above 50, when the D value is crossed twice from top to bottom, the stock price will fall more.

Parameter: N, M1, M2 days, generally take 9, 3, 3.

Rules of use:

1. When the D value is above 80, the market is overbought. When the D value is below 20, the market is oversold.

2. When the stochastic index deviates from the stock price, it is generally a signal of a turning trend.

3. When the value of K is greater than the value of D, it shows that the current trend is upward; when the value of D is greater than the value of K, it shows that the current trend is downward.

4. When the K line breaks through the D line upwards, it is a buy signal, which is the KDJ Golden Cross. This kind of buy signal is more accurate when it is formed above 70.

5. On the contrary, the K line fell and broke the D line, which is a signal to sell, that is, KDJ dead fork. This kind of buy signal is more accurate when it is formed below 30.

6. When the indicator is hovering or crossing around 50, it is of little reference significance.

7. When the K value and D value rise or fall at a slower rate, and the slope tends to be flat, it is an early warning signal of a short-term turnaround.

8.KD is not suitable for stocks with too small issuance and trading too small; but it has extremely high accuracy for indexes and popular large stocks.

MACD Index Smoothing Average Line of Convergence and Divergence

This indicator mainly uses two long and short-term smoothing average lines to calculate the difference between the two. This indicator can remove the false signals that often appear in the moving average, while retaining the advantages of the moving average. However, since this indicator is not highly sensitive to price changes, it is a medium and long-term indicator, so it is not applicable in the consolidation market. A bar from green to red is a buy signal, and a bar from red to green is a sell signal. When the MACD curve crosses downwards twice from the high-end, the stock price will fall more deeply. When the MACD curve crosses upwards twice from the low end, the stock price will rise more. When the high of the stock price is higher than the previous high, but the high of the MACD indicator is lower than the previous high, it is a bull divergence, implying that the stock price will reverse and fall.

Parameters: SHORT (short-term), LONG (long-term), M days, generally 12, 26, 9.

Applicable rules:

1. When both DIF and DEA are positive, that is, when both are above the zero axis, the general trend is a long market, and DIF breaks through DEA upwards and can be bought if DIF falls below DEA, which can only be used as a signal to close a position.

2. Both DIF and DEA are negative, that is, when both are below the zero axis, the general trend is a short market, and DIF falls below DEA and can be sold.

3. When the DEA line deviates from the K line trend, it is a reversal signal.

4. DEA has a higher turnover rate in the game, but if you cooperate with RSI and KD, you can make up for the shortcomings.

5. Analyze the MACD histogram. When it changes from positive to negative, it often indicates the time to sell, and vice versa is often a buy signal.

ROC rate of change

When ROC falls below zero, a sell signal; ROC breaks above zero, a buy signal. The stock price hit a new high, and the ROC did not cooperate with the rise, indicating that the upward momentum has weakened. The stock price hit a new low and the ROC did not cooperate with the decline, indicating that the downward momentum has weakened. The stock price and ROC have risen at the same time from the low, and a short-term rebound is expected. The stock price and ROC have dropped from the high at the same time, so be wary of the fall.

Parameter: N, the number of days between intervals; M, the number of days to calculate the moving average. Generally take 12, 6. 7. RSI relative strength index (Relative Strenth Index) short-term RSI below the level of 20, cross the long-term RSI from bottom to top, it is a buy signal. The short-term RSI is above 80, and it crosses the long-term RSI from top to bottom, which is a sell signal. The stock price is lower than the wave, on the contrary, when the RSI is higher than the wave, the stock price can easily reverse and rise. When the stock price is higher than the wave, on the contrary, when the RSI is lower than the wave, the stock price can easily reverse and fall. RSI below 50 is a weak zone, and above 50 is a strong zone. Breaking through the 50 line from bottom to top means changing from weak to strong, and breaking through the 50 line from top to bottom means changing from strong to weak. It is generally believed that the accuracy of RSI above 50 is higher.

Parameters: N1, N2, N3 count days, usually 6, 12, 24.

TRIX triple indicator smoothed average line

This indicator is a triple exponential smoothed average line. The signal of this indicator is used in long-term operation, which can be filtered out The interference of some short-term fluctuations can avoid too frequent transactions, resulting in some unprofitable transactions and loss of handling fees, but this indicator is not applicable in the consolidation of the market. TRIX crosses its MA line upwards as a buy signal, TRIX crosses its MA line downwards as a sell signal. There is a view that the indicator may be distorted when judging selling.

Parameters: N, M days, generally 12, 9.

W&R William's %R (William's %R)

Below 20, overbought, peaking soon, should be sold in time. Above 80, it is oversold and bottom is about to be reached, so you should wait for an opportunity to buy. This indicator is used in conjunction with the RSI and MTM indicators to achieve better results.

Parameter: N Counting days generally take 14 days.

ARBR Popularity Willingness Index

AR is a kind of "potential momentum". Since the opening price is a reasonable price that the stockholders agree with after a night of calm thinking, then, pushing up from the opening price to the highest price of the day will lose a cent of energy every time it exceeds a price. When the AR value rises to a certain limit, it means that the energy has been exhausted, and the stock price that lacks the power to boost will soon face a crisis of reversal. On the contrary, the stock price has not risen since the opening of the market, which naturally reduces the energy loss, and relatively saves a lot of accumulated energy. This intangible potential may be exploded at the appropriate and mature time at any time. . BR is an "emotional indicator" based on the "anti-market psychology" position.

The AR popularity index is between 80 and 100, consolidating; too high, falling; too low, rebounding. The BR willingness indicator ranges from 70 to 150, consolidating; above 300, retracement; below 50, rebounds.

Parameter: N days, generally 26

CR energy indicator

This indicator is used to determine the timing of buying and selling. It can measure the popularity of popularity and the potential of price momentum; display pressure bands and support bands to assist BRAR shortcomings. The area sandwiched by the two lines a and b is called the "secondary seismic zone". When CR wants to cross the secondary seismic zone from bottom to top, the stock price will be relatively interfered by the secondary pressure; when CR wants to cross the secondary seismic zone from top to bottom At that time, the stock price will relatively encounter secondary support interference. The area sandwiched by the two lines c and d is called the "main seismic zone". When CR wants to cross the main seismic zone from bottom to top, the stock price will encounter strong pressure interference; when CR wants to cross the main seismic zone from top to bottom At that time, the stock price will relatively encounter strong support interference. When CR falls below the four lines a, b, c, and d, and climbs 160% from the low point again, it is an opportunity to sell for short-term profit. When CR falls below 40, the chance of the stock price forming a bottom is quite high. When CR is higher than 300~400, the stock price can easily reverse downward.

Parameter: N statistical days M1, M2, M3 the number of days to calculate the moving average, generally 5, 10, 20.

ASI Vibration Rise and Fall Index

When ASI falls below the previous low point, it is a sell signal, and when ASI breaks above the previous high point In order to buy a signal, the price is going from bottom to top. When you want to cross the high point hold-up zone of the previous wave, it is close to the high point and it is not yet certain whether it will pass smoothly. If ASI is ahead of the stock price, one step ahead of time to pass the previous wave of ASI highs relative to the stock price, then after the next day, it can be determined that the stock price will inevitably break through the high-point hold-up zone smoothly. When the stock price moves from top to bottom, when it wants to cross the dense support zone of the previous wave of low points, it is close to the low point and it is not yet certain whether it will break through the support due to loss of confidence. If ASI leads the stock price, one step earlier and falls below the previous wave of ASI lows relative to the stock price, then after the next day, it can be determined that the stock price will subsequently fall below the price point support zone. When the stock price moves higher and higher, but ASI has not formed a "bull divergence" from a new high, it should be sold. When the stock price trend is lower and lower, but ASI has not formed a "bear divergence" from a new low, you should buy.

BOLL Bollinger Bands

This indicator uses wave bands to show its safe high and low prices. The stock price travels within the band between the "upper limit" and the "lower limit". When the stock price increases or decreases, the band becomes wider, and when the price decreases, the band becomes narrower. When crossing the "upper limit" upwards, a short-term retracement will be formed, which is a short-term selling opportunity. When the stock price crosses the "lower limit", it will form a short-term rebound, which is a short-term buying opportunity. When the band of Bollinger Bands moves in the horizontal direction, it can be regarded as being in the "normal range". At this time, the two methods of use 1, 2 are adopted, and the reliability is quite high. If the belt zone moves to the upper right or lower right, it is out of the normal state, and it has a special meaning. When the wave band narrows, fierce price fluctuations may occur at any time.

Parameter: N sets the number of statistical days, generally 26. P sets the width of the BOLL tape, generally 2.

MIKE indicator

This indicator is a pressure support indicator that changes with the fluctuation of the stock price. The pressure above the stock price is called the "upper limit." , The support below the stock price is called the "lower limit." Between the first "upper limit" and the first "lower limit", we set an imaginary middle line. When the stock price is above the middle line, refer to the "upper limit" pressure value; when the stock price is below the middle line, refer to the "lower limit" "Support value. When the stock price deviates from the consolidation and moves toward an upward trend, the three "upper limits" above the stock price are the pressure reference prices. When the stock price deviates from the consolidation and moves towards a downward trend, the three "lower limits" below the stock price are the supporting reference prices. During consolidation, if the stock price is higher than the middle line, the "upper limit" price is selected as the reference basis; if the stock price is lower than the middle line, the "lower limit" price is selected as the reference basis. (Attention! In some stock market software, the performance is changed to "table", directly displaying the pressure and support data in the table, and it will indicate that the "upper limit" or "lower limit" price should be referred to at this stage. But we think Drawing into a graph can better reflect the changing trend of this indicator.)

Parameter: N is generally 26.

Limitations

The changes in technical indicators and the buying and selling signals issued are the values reflected in the indicators in the market, and they are also the prior changes in the market. If the market does not change, the indicator will not display and send a signal. If a buy signal is issued at this moment, and a sell signal may be issued at the next moment, both possibilities exist. Therefore, the changes in technical indicators and the buying and selling signals sent out are still a random process. Therefore, technical indicators reflect the past of the market and predict the possibility of future market trends.

Many technical indicators are prone to passivation and often send out some false buying and selling signals. Therefore, many reversal signal errors in the stock market are caused by the passivation of technical indicators, especially when the stock price deviates from the top or the bottom, its sensitivity and reliability are poor.

Each technical index is a partial and one-sided index. The parameters and variables selected for each indicator are too simple and can only reflect the partial trend of stock prices, and cannot truly reflect the capital, fundamental, technical, policy, and speculative methods of the stock market.

There are thousands of known technical indicators, almost all of which use the principle of moving averages. They all use a short-term fast moving average to cross a long-term slow moving average to generate a cross to send out buying and selling signals. , There are no new ideas and breakthroughs in forecasting technology. The author has done dynamic stock trading statistics on dozens of technical indicators, and found that all technical indicators that have been statistically cannot guide investors to invest. The reason is simple, that is, when they send out a buy signal, investors buy stocks, and the stock price rises. The probability is only 50%, and there is a 50% probability of falling.

If the technical indicators are combined with the trend line theory, it can be calculated that when the stock price is running in the upward channel and the technical indicators send out the signal to buy and sell stocks, the probability of the stock price rising can be greater than 50%. In the downward channel, the probability of stock prices rising is less than 50%.

Momentum indicator

MTM principle and calculation

MTM is the difference between the closing price V of the day and the closing price VN before N Difference M, connect each M value calculated in sequence, that is, the calculation formula of MTM line MTM is:

M=V-VN

Here, two fixed time intervals The difference between closing price parameters includes the concept of speed change. If V > VN continues, and the difference M becomes larger and larger, it means that the market is accelerating; if V

Application of MTM

1. Generally, N=10.

2. Generally speaking, the upward crossing of the 0 axis of MTM is a buy signal, and the downward crossing of the 0 axis is a sell signal. But if M=0, then V=VN, then during the N-day period, the market momentum may shift, or it may rise and then return, or it may fall and then rise. Therefore, the buying and selling signals near the O-axis need to be handled carefully, including:

①Adjust the up and down of the city road MTM near the 0-axis and ignore it;

②The upward trend is reversed , MTM crosses the 0 axis as a sell signal;

③The downward trend is reversed, and the MTM crosses the 0 axis as a buy signal;

④During the rise, it is possible that the MTM crosses the 0 axis. It is a false breakthrough, and the retracement ends and the subsequent rise;

⑤During the decline, the MTM may be a false breakthrough when it crosses the O axis, and it will fall again after the rebound.

It can be seen that MTM operations should have other indicators to help identify trends.

3. Usually when the market situation has completed rapid development and begins to decelerate (but has not reached the top or bottom), the MTM indicator has taken the lead to turn downward or upward. Therefore, the MTM indicator is ahead of price changes. Experience shows that the lead time is about 3 days. In this way, the upper and lower inflection points of MTM are early warning signs of price inflection points.